In a world reshaped by economic shifts and unexpected turns, true financial security goes beyond just your paycheck or how smart you are with numbers. It lives deep down, in the way our minds are built, in the quiet yet powerful mental maps that decide how we see, deal with, and ultimately shape our money story. Far from being a dry list of rules, financial success is a journey led by our inner thoughts.

10 Psychological Tips for Financial Success

1. The Growth Mindset: Learning and Getting Better

According to this theory, which was popularised by psychologist Carol Dweck (2006), our abilities are not fixed. Instead, with work and education, people may develop and improve. In terms of money, this entails viewing financial errors as constructive criticism rather than significant failures. Consider a person who was not taught how to manage money as a child. They would respond, “I might not know how to manage money yet, but I can learn,” if they had a growth mentality. This style of thinking helps kids become more financially smart, removes embarrassment, and sparks their curiosity.

Survival Tip: Turn your attention to education while dealing with financial difficulties like debt or poor income: “What can this teach me?” Read a finance book, join a budgeting class, or follow credible money experts online. Celebrate small wins.

2. The Fresh Start Mindset: A New Beginning Every Day

The “fresh start effect,” explained by Dai, Milkman, and Riis (2014), shows how special times like birthdays, Mondays, or New Year’s Day mentally separate us from past mistakes. They give us a feeling of a clean slate. Imagine someone who spent too much on their credit card. The start of a new month can be their chance to make a fresh budget, let go of past errors, and really commit to being smart with their money. Studies show these fresh starts make people stick to their goals more and help break bad habits.

Survival Tip: Use new calendar months or your birthday to set small money goals, like “No ordering food this week.” Treat it like a special routine to kickstart lasting good habits and find your way to financial success.

3. Self-Efficacy & Internal Locus of Control

Financial success is built on two main ideas: self-efficacy, which is believing you can handle money well (Bandura, 1997), and an internal locus of control, which is believing your actions, not outside forces, decide your financial results (Rotter, 1966; Lim et al., 2003). Compare two people earning the same amount. One thinks, “I can learn to budget and invest,” while the other says, “I’m just bad with money.” The first person will look for knowledge, try new tools like budgeting apps, and take action. Even small wins, like saving ₹500 in a week, build confidence and get things moving. These mindsets are known to lower money worries.

Survival Tip: Start with one easy goal, like tracking your spending for a week. Celebrate when you do it to build trust in yourself. Over time, you’ll feel confident tackling bigger tasks.

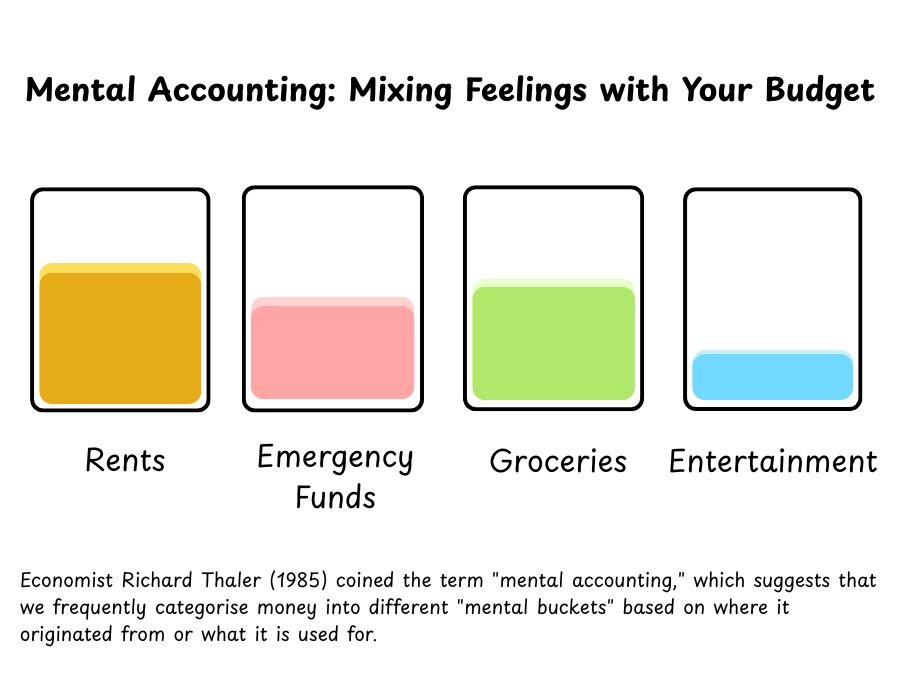

4. Mental Accounting: Mixing Feelings with Your Budget

Economist Richard Thaler (1985) coined the term “mental accounting,” which suggests that we frequently categorise money into different “mental buckets” based on where it originated from or what it is used for. This can help organise things, but it can also lead to strange money choices. Knowing about this prejudice enables you to make better choices. Savings designated for specific purposes (such as “Emergency Fund” or “Travel Fund”) make the money feel valuable and untouchable, which reduces impulsive purchases.

However, it is also vital to be flexible. Use digital envelopes or different bank accounts to monitor your spending. Divide ₹5,000 into rent, groceries, travel, and emergencies. Review your finances on a frequent basis; if one item, such as rent, rises, modify others (for example, cut entertainment) rather than going into debt.

5. Future Orientation and Long-Term Planning: Thinking Years Ahead

Thinking about the future enables people to see their lives in 5, 10, or 20 years and make better financial decisions right now. Those who frequently consider their future self tend to save more, postpone immediate gratification, and avoid impulsive purchases (Hershfield et al., 2011; Lakew et al., 2024). Consider two friends: one spends all of their money on current living expenses, while the other continuously contributes to a retirement fund, even if the returns appear to be minimal. In 10 years, the second friend will have more money and also a greater sense of financial security. Seeing your future self connects today’s joy to tomorrow’s security.

Survival Tip: Write a letter to your 40-year-old self about the life you want: your job, health, travel, or being financially free. Use this letter to guide your spending now. Set big goals like “₹10 lakh for travel in 5 years” and break them down into monthly actions.

6. Mindfulness: Being Present and Smart About Money

Mindfulness is defined as paying attention to the current moment without judging it. This enables you to spend less emotionally and make more responsible financial judgements (Gentina et al., 2020). Instead of reacting to a limited-time offer, a smart individual asks, “Do I really need this?” Being attentive to your spending patterns not only prevents regrets but also guarantees that your financial actions are consistent with your actual convictions.

Survival Tip: Before purchasing something unnecessary, wait for 60 seconds and analyse the impulse. “Is this aligned with my long-term goals?” Identify the factors for impulsive spending, such as boredom or stress.

7. Frugality & Self Control: Making Smart Choices for Financial Success

Being frugal does not mean going without; it means making wise spending decisions that improve your financial health in the long run. When you develop self-control, you gain the capacity to delay gratification in favour of broader goals. Consider updating your phone and putting the remaining ₹10,000 into mutual funds. Over time, such little, recurring choices add up to genuine wealth (Moffitt et al, 2011; Buameister et al., 1994)

Survival Tip: Use the 24-hour rule: Wait a full day before acting on an impulse purchase. If it still fits your aims, go forward. Set explicit restrictions for categories such as entertainment. For large purchases, such as a ₹3,000 course, make sure it enhances a skill or supports a value you care about.

8. Risk Tolerance & Entrepreneurial Mindset: Taking Chances Wisely

In an ever-changing and uncertain environment, being willing to take calculated chances and think like an entrepreneur may lead to strength and success. People who are more open to risk are not afraid to make strategic investments, try side occupations, or develop money-making skills (Weber et al. 2002). For example, an individual may invest ₹5,000 in an internet business or cryptocurrency, learning from both successes and failures. Risk becomes an opportunity to explore new things.

Survival Tip: Set aside 5–10% of your income as an “opportunity fund” to explore ideas like a design course, a freelance tool, or a startup concept.

9. Ethical & Social Awareness: Growing with Goodness

Money is not just about you; it affects everyone. Smart money habits also include how your decisions influence others. According to research, people who consider social responsibility while making financial decisions are happier and less prone to spend in detrimental ways (Barber et al., 2021). Choosing to bank with firms that do good, or investing in organisations that have great environmental and fair labour standards, for example, allows you to promote your beliefs while also improving the world.

Survival Tip: Add a “giving” or “impact” line to your budget, just ₹500 a month toward a cause you care about can bring deeper meaning to your financial life. Explore ESG (Environmental, Social, Governance) funds for responsible investing. Ask, “Does this purchase help or harm others?”.

10. Adaptability & Financial Resilience: Bouncing Back Stronger

In a world of layoffs, pandemics, and market crises, adaptability is as crucial as planning. Financial resilience entails having the emotional and practical strength to deal with significant changes such as changing occupations, lowering living expenses, or dealing with rising prices (Carton et al., 2024). Consider someone who lost their work but had enough funds to last four months, a diverse skill set, and the desire to freelance or fast learn something new. That individual not only gets it through, but also develops stronger.

Survival Tip: Build a savings cushion covering 3–6 months of essentials like rent, food, and utilities. Keep upskilling, that is, learn digital tools, AI, or tax planning. Review your money plan every three months and always ask, “What’s my backup?” Whether it’s a side job or career shift, adaptability ensures not just recovery, but progress.

Final Thoughts

Financial survival and enduring success aren’t just for the lucky or the rich. They are built by growing strong mindsets like being tough, thinking ahead, being disciplined, and showing kindness that empower you to handle life’s unknowns. You don’t have to master all ten at once. Start with one, practice it daily, and watch how your relationship with money changes, not just your bank account, but your inner peace and sense of purpose too.

FAQs

1. How is psychology connected to financial success?

Psychology plays a critical role in shaping financial behaviour. Our beliefs, emotions, and mental habits influence how we save, spend, invest, or avoid money decisions. Mindsets like self-efficacy, future orientation, and emotional regulation can help us make better, more consistent financial choices.

2. I’m not good with numbers, but can I still apply these principles?

Absolutely. These strategies don’t require advanced math. They focus on building awareness, habits, and confidence. Even simple actions like tracking expenses or visualising your future self can significantly improve financial outcomes over time.

3. What’s the most important mindset to start with for Financial Success?

Start with the Growth Mindset. Believing you can learn and improve your financial skills lays the foundation for applying the rest, whether it’s budgeting, investing, or building resilience after setbacks.

4. Can these principles help with financial anxiety?

Yes. Techniques like mindfulness, mental accounting, and self-efficacy help reduce financial stress by creating clarity and a sense of control. When you replace guilt with curiosity and planning, it becomes easier to cope with challenges.

5. I don’t have a steady income, will this still work for me?

Definitely. These strategies are especially useful for unpredictable situations. Concepts like adaptability, frugality, and creating an “opportunity fund” help you build flexibility and make smart choices even with irregular earnings.

References +

References

- Dai, H., Milkman, K. L., & Riis, J. (2014). The fresh start effect: temporal landmarks motivate aspirational behaviour. Management Science, 60(10), 2563–2582. https://doi.org/10.1287/mnsc.2014.1901

- Mindset: The new psychology of success. (n.d.). https://psycnet.apa.org/record/2006-08575-000

- Self-efficacy: The exercise of control. (n.d.). https://psycnet.apa.org/record/1997-08589-000

- Generalized expectancies for internal versus external control of reinforcement. (n.d.). https://psycnet.apa.org/doiLanding?doi=10.1037%2Fh0092976

- Lim, V. K., Teo, T. S., & Loo, G. L. (2003). Sex, financial hardship and locus of control: an empirical study of attitudes towards money among Singaporean Chinese. Personality and Individual Differences, 34(3), 411–429. https://doi.org/10.1016/s0191-8869(02)00063-6

- Thaler, R. (1985). Mental accounting and consumer choice. Marketing Science, 4(3), 199–214. https://doi.org/10.1287/mksc.4.3.199

- Hershfield, H. E., Goldstein, D. G., Sharpe, W. F., Fox, J., Yeykelis, L., Carstensen, L. L., & Bailenson, J. N. (2011). Increasing saving behaviour through Age-Progressed renderings of the future self. Journal of Marketing Research, 48(SPL), S23–S37. https://doi.org/10.1509/jmkr.48.spl.s23

- Lakew, G., Rana, P., & Goyal, A. (2024). Future self-connectedness and financial planning behaviour. Journal of Behavioural Finance, 25(1), 66–79.

- Kim, J., Kim, S., & Choi, J. (2019). Purchase now and consume later: Do online and offline environments drive online social interactions and sales? Journal of Business Research, 120, 274–285. https://doi.org/10.1016/j.jbusres.2019.09.021

- Baumeister, R. F., Heatherton, T. F., & Tice, D. M. (1994). Losing control: How and why people fail at self-regulation. Academic Press.

- Moffitt, T. E., Arseneault, L., Belsky, D., Dickson, N., Hancox, R. J., Harrington, H., Houts, R., Poulton, R., Roberts, B. W., Ross, S., Sears, M. R., Thomson, W. M., & Caspi, A. (2011). A gradient of childhood self-control predicts health, wealth, and public safety. Proceedings of the National Academy of Sciences, 108(7), 2693–2698. https://doi.org/10.1073/pnas.1010076108

- Weber, E. U., Blais, A. R., & Betz, N. E. (2002). A domain-specific risk-attitude scale: Measuring risk perceptions and risk behaviors. Journal of Behavioral Decision Making, 15(4), 263–290. https://doi.org/10.1002/bdm.414

- Barber, B. M., Morse, A., & Yasuda, A. (2021). Impact investing. Journal of Financial Economics, 139(1), 162–185. https://doi.org/10.1016/j.jfineco.2020.07.008

- Carton, K., Smith, E., & Madsen, J. (2024). Financial resilience in the face of global disruption: A behavioural framework. Journal of Economic Psychology, 98, 102556. https://doi.org/10.1016/j.joep.2024.102556

Leave feedback about this